Important information - .

In This Article

- Aave Partners With CoinDesk To Launch CDOR: What Does It Mean?bitcoin wallet locator samsung

- A New Era for DeFi?

Aave and CoinDesk Indices are launching CDOR, an onchain benchmark for stablecoin interest rates, starting with USDT and USDC. Built on Aave V3 data, CDOR could redefine DeFi, mirroring SOFR in TradFi.

The United States is keen on ensuring stablecoins backed by Treasuries thrive. With the passage of the GENIUS Act in the Senate, Congress now has to debate and is highly likely to approve the bill.

Despite some lawmakers, including Elizabeth Warren, arguing that certain amendments to the GENIUS Act were not considered, the bill has garnered bipartisan support. If passed in Congress, it will create a framework enabling companies to launch stablecoins with clarity on their legal standing.

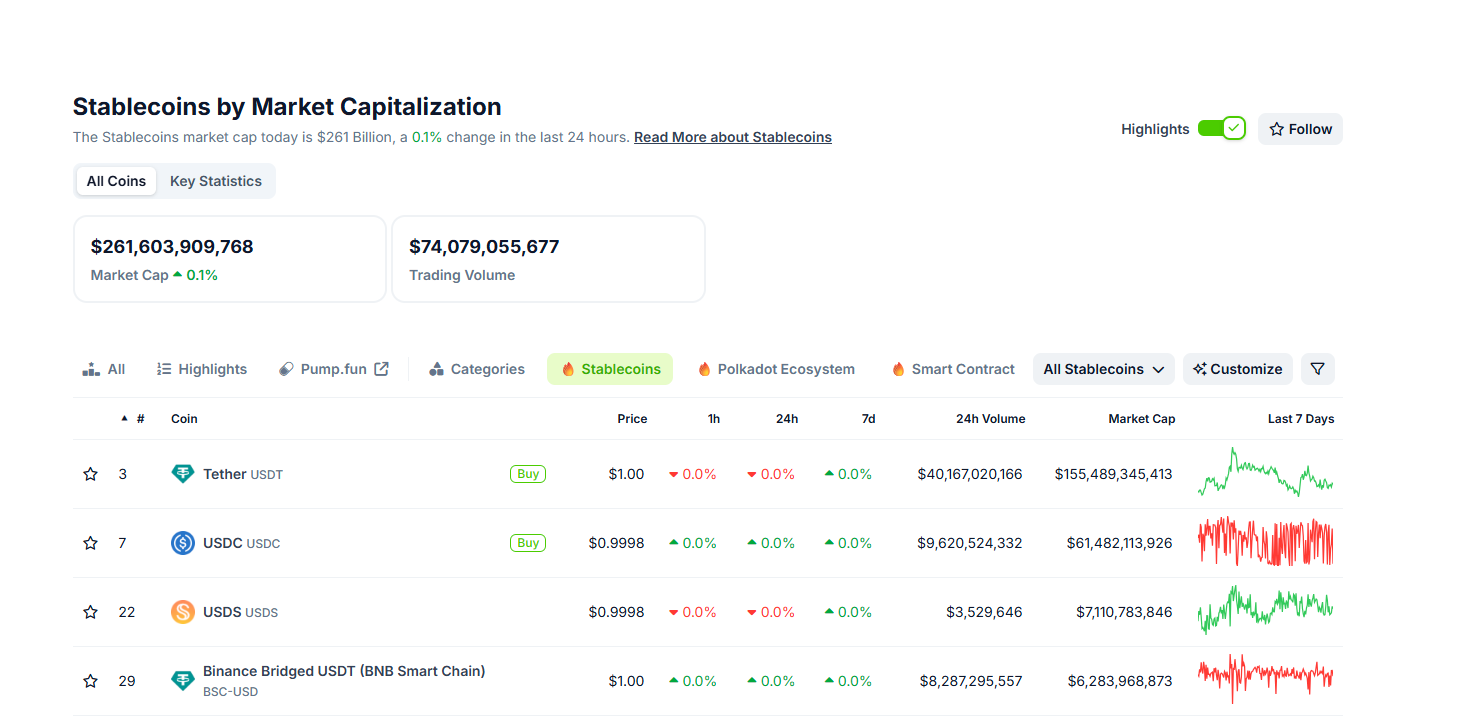

Presently, the stablecoin market is growing, even allowing investors to buy some of the next 1000X cryptos. As of June 18, the total market cap of all stablecoins was more than $261 billion.

(Source)

USDT, the first stablecoin, remains the largest, with over $155 billion in market cap. It is way more valuable than all of the best cryptos to buy, excluding BTC ▲0.88%

ETH ▲2.85%

USDC by Circle, which recently went public and listed on the NYSE, is the second largest, with over $61 billion.

Algorithmic stablecoins, such as USDS and Ethena Labs’ delta-neutral USDE, are also popular among yield-seeking investors.

Share this article