Important information - .

In This Article

- How is blockchain zendesk customerSOL USD Price Action Shaping Up Ahead of New Solana Layer 2?

- Best Solana Crypto To Buy? Solaxy Is The First Solana Layer-2 Built for the Institutional Era

- Tokenomics Designed for Growth and Utility

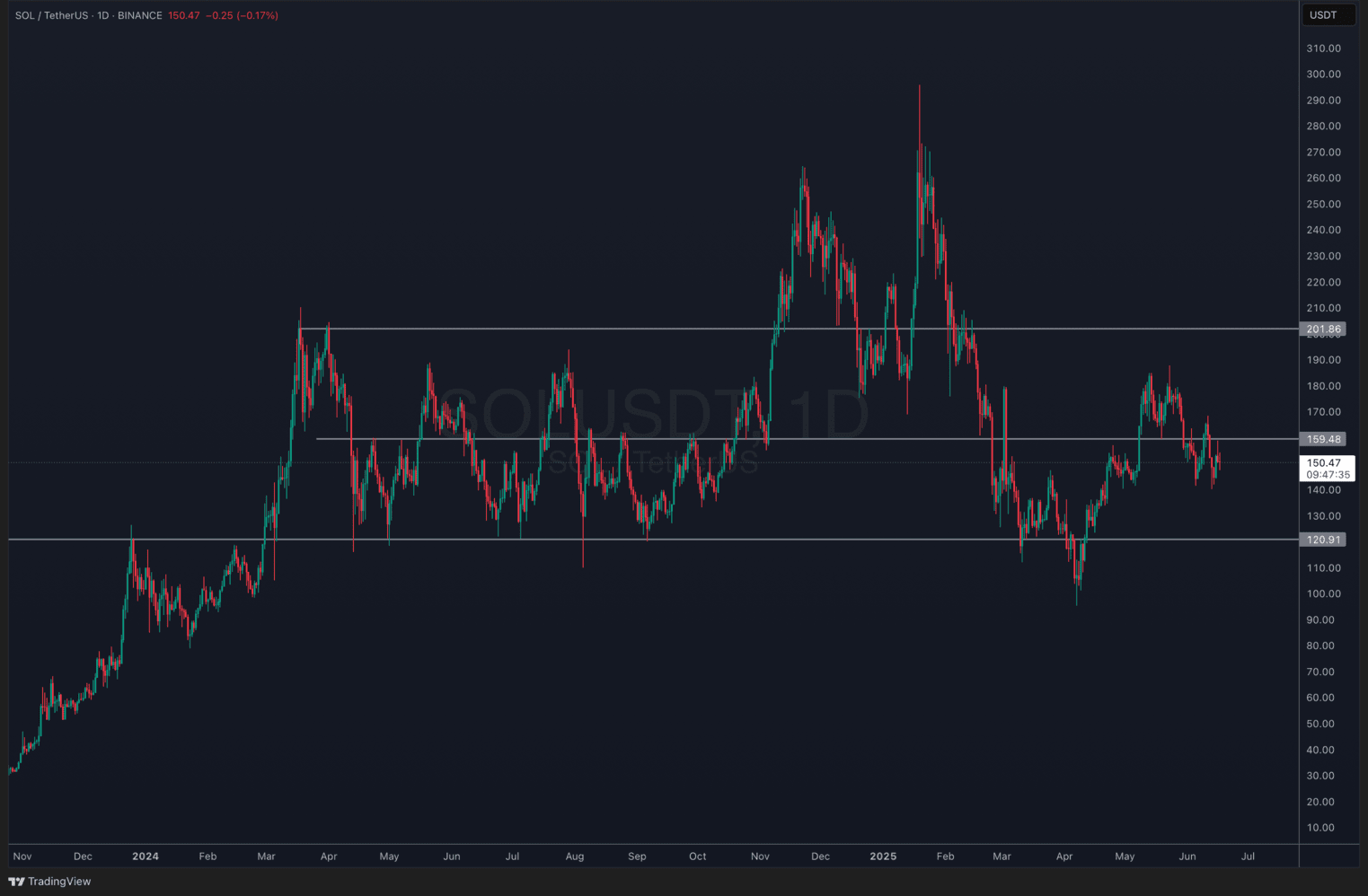

Solana’s price recently experienced two minor corrections in response to geopolitical tensions, briefly falling from $166 to $142 before rebounding. The second dip was milder, with SOL holding above $150, signaling typical short-term market volatility. As investors look beyond short-term swings, attention is turning to emerging projects competing for the title of the best Solana crypto, especially as institutional adoption heats up.

Looking at the bigger picture, SOL has been trading sideways since February 2025. After a brief spike to nearly $300 in January, the token has settled into a broader range between $120 and $180. This current phase mirrors Solana’s 2024 behavior, although slightly lower in range, indicating a cooling period following previous speculative highs.

How is SOL USD Price Action Shaping Up Ahead of New Solana Layer 2?

Historically, Solana has shown resilience. After bottoming out post-2021 bull run, it steadily recovered in 2023, reaching $100 by early 2024. While some mini-bubbles inflated along the way, SOL has largely entered a consolidation phase.

(SOLUSDT)

On the news front, several developments could influence SOL’s future price.

Solana is gaining serious traction in the institutional world. The U.S. SEC has asked ETF applicants to revise and resubmit S-1 filings related to Solana, signaling a possible approval window in the next 30 days. Multiple asset managers, including Fidelity, Franklin Templeton, Grayscale, and VanEck, are racing to launch the first Solana ETF. The SEC appears open to limited staking within these structures. With approval potentially coming as early as July, institutional capital could soon flow into Solana’s ecosystem.

In parallel, Cantor Fitzgerald, one of Wall Street’s top brokerages, has initiated coverage on three companies holding Solana in their corporate treasuries: DeFi Development (DFDV), Upexi (UPXI), and Sol Strategies (HODL). Cantor assigned “overweight” ratings, citing Solana’s superior speed, lower fees, and expanding developer base as reasons it may outperform Ethereum in on-chain financial infrastructure. This marks a strategic shift toward Solana as a long-term treasury and capital management asset, fueling even more demand for scalable solutions.

Look around us:

-Cantor Fitzgerald citing $SOL as a better treasury asset than $ETH because of dev growth

-Odds of Solana ETF by July 31 surging to 76% on Polymarket

-An index of top ecosystem projects being launched by $SSR partnering with Enigma Fund VCFuture looking good

— Kuj Crypto (@kujcrypto) June 17, 2025

Best Solana Crypto To Buy? Solaxy Is The First Solana Layer-2 Built for the Institutional Era

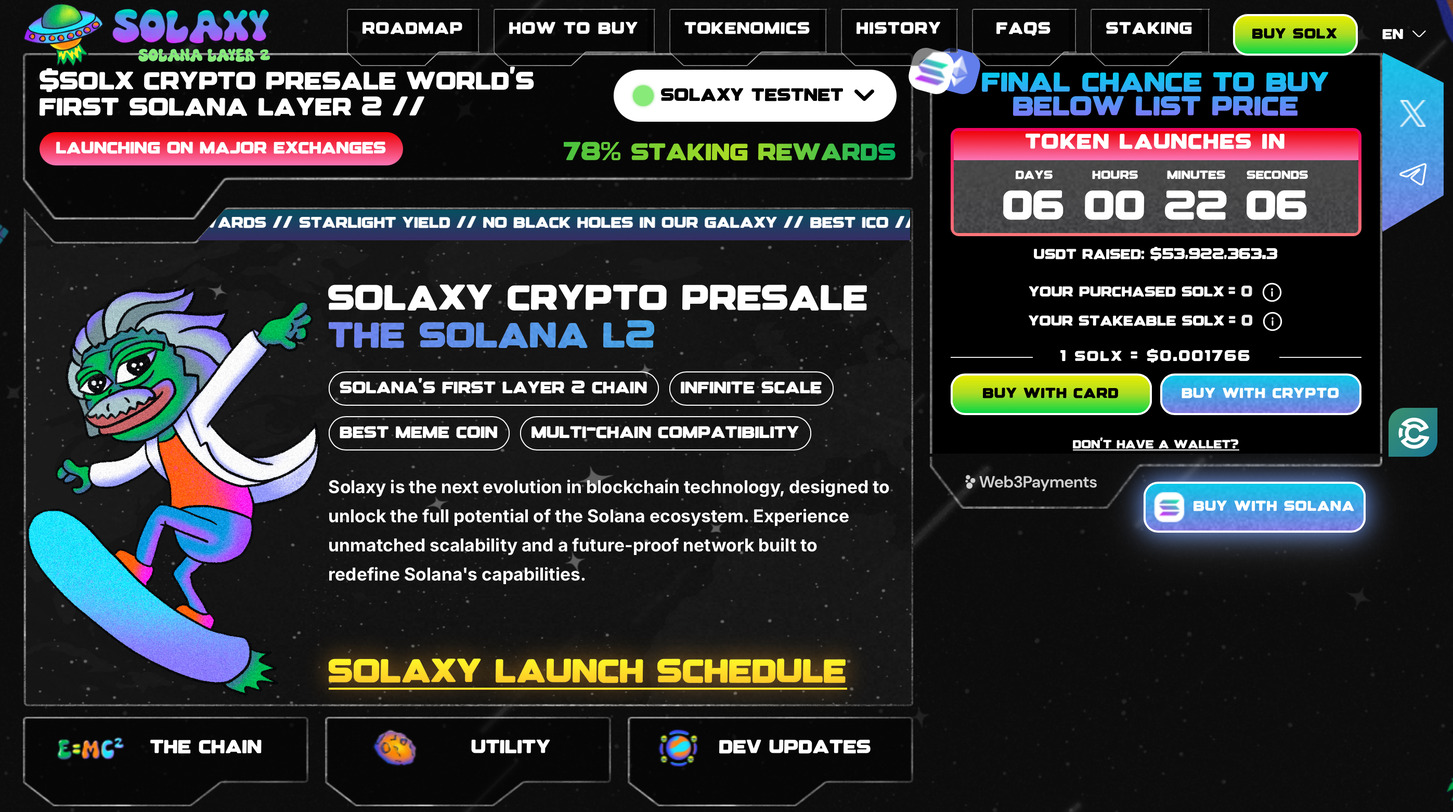

As Solana edges closer to institutional adoption, via ETF approvals and Wall Street-backed treasury plays, the pressure on its infrastructure is bound to intensify. While Solana’s native performance is impressive, network congestion and failed transactions have historically hindered its full potential. This is where Solaxy (SOLX) enters the picture.

Solaxy is the first-ever Layer-2 scaling solution built specifically for Solana, designed to eliminate the performance bottlenecks that have constrained Solana during high-traffic periods, like bull runs, major token launches, or NFT mints. It doesn’t stop there: Solaxy is also bridging Ethereum liquidity into Solana’s fast and efficient environment, opening the door for massive DeFi inflows.

At its core, Solaxy significantly boosts transaction throughput by introducing advanced parallel processing. This means the network can handle surges in activity, whether from gaming, trading, or NFTs, without slowing down or failing.

Equally important is its micro-fee architecture, which allows users to perform actions incredibly cheaply. This is a game-changer for DeFi users and gamers who rely on high-frequency transactions and can’t afford heavy network fees.

Another key innovation is Solaxy’s bridge to Ethereum. This isn’t just about compatibility. It’s about tapping into Ethereum’s massive liquidity and established DeFi ecosystem while still benefiting from Solana’s speed. The platform includes:

- Neptoon DEX – A Solana-native exchange with deep liquidity and real-time execution.

- Igniter Protocol – A launchpad for new tokens and projects within the Solaxy ecosystem.

- Live Testnet – Including block explorer and cross-chain bridge, already active and in use.

Tokenomics Designed for Growth and Utility

SOLX integrates into every layer of the Solaxy ecosystem: staking, transaction fees, liquidity incentives, and protocol governance. Investors can currently earn staking rewards above 78% APY, although this rate will decline as the pool grows. A total of 25% of the token supply is reserved for rewarding early adopters, making early participation especially lucrative.

Solaxy has already raised nearly $54 million in its presale, underscoring serious investor interest. The project has attracted attention from DeFi whales, meme coin traders, and infrastructure-focused funds alike, each recognizing that scalability is the next battleground in Layer-1 ecosystems.

Amid rising demand for Solana ETFs, increased corporate treasury interest backed by Cantor Fitzgerald, and the growth of on-chain capital management, Solaxy is emerging as one of the best Solana crypto assets to buy.

Visit SNORT HereShare this article